Duration: 30 months

Technologies: Rails API, AWS, React

Team: 2 Frontend Devs, 3 Backend Devs, 1 UX, 1 Tester, 1 PM

The Client

adoc.description_section.product

The Challenge

The client's need was to optimize their processes and have a custom management software capable of handling all the activities of the company and its financial advisors

Solution

Following an analysis of the processes, in collaboration with the customer, we were able to design a Cloud-based solution that would allow all the main operations to be digitized.

The platform acts as a portal for clients and financial advisors and through it consultants are able to register and profile customers, managing their assets and the phases of investment contracts. The system fully automates the generation of related documentation and allows advanced electronic signature by subscribers.

The system allows you to manage orders according to a step-by-step procedure, which begins at the creation of the order, continues to the the validation of the back-office, and ends at the actual execution.

The system is equipped with automated mechanisms for interfacing with the main banks, insurance companies and asset management companies, which receive hundreds of transactions daily.

All the daily activities that allow the Securities Brokerage Firm to operate can be managed through the platform, such as accounting management and billing to consultants, reports to supervisory bodies and the monitoring of the sales network.

Client profiling

Guided client registration procedures with automatic generation of pre-filled documentation.

Order management

Automation of order generation processes based on product types and related settings.

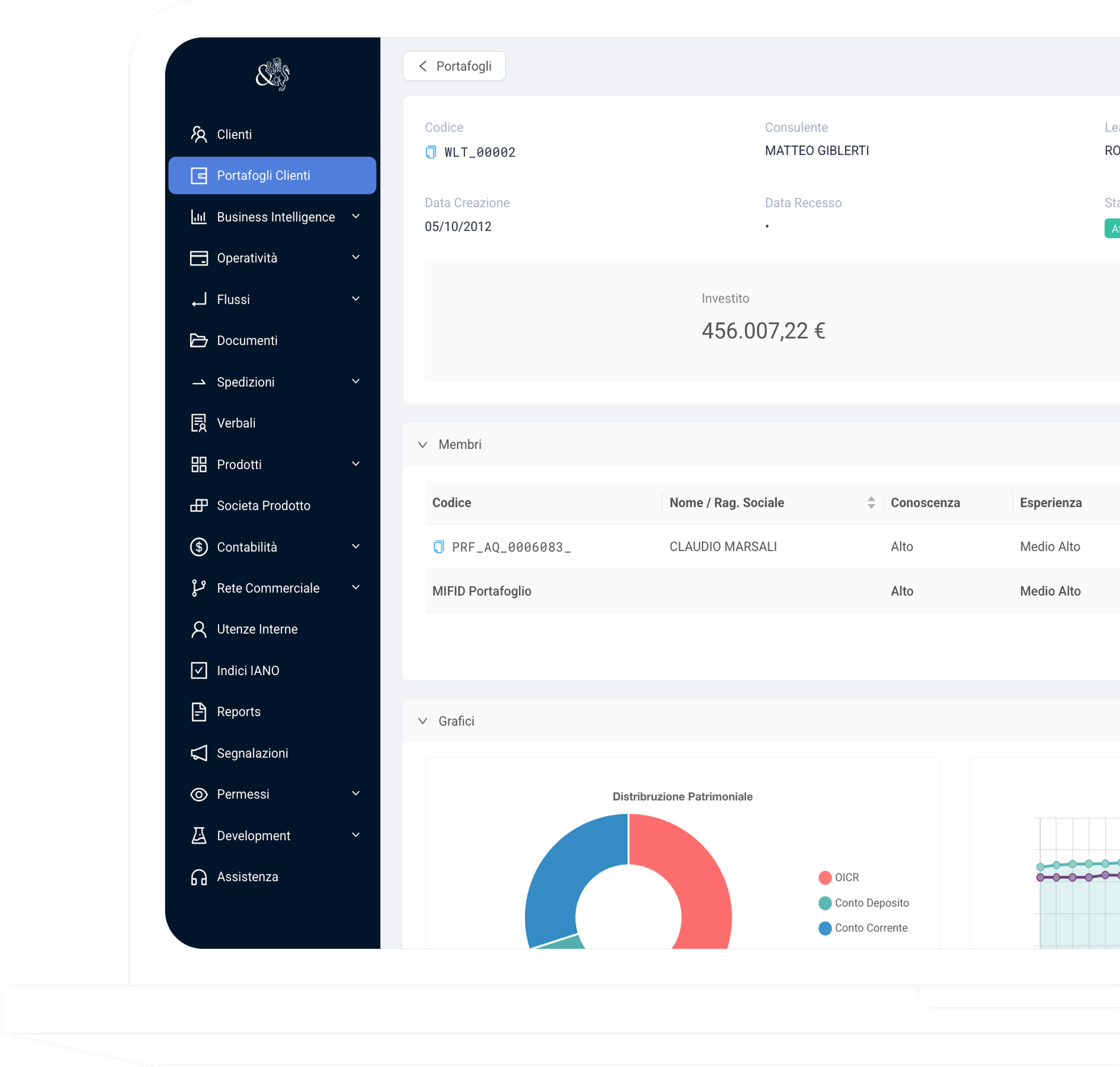

Portfolio monitoring

Ability to monitor portfolio investments through dashboards and summary charts detailing transactions and returns.

Digital signature

Advanced electronic signature and integrated documentation storage directly on the platform.

Back-office automation

Automated procedures for managing back-office activities such as order acceptance, client verification, regulatory compliance, and financial transaction accounting.

Accounting management

Automated management of accounting and commission calculations, with reporting and invoicing to advisors according to the relevant period.

Sales network

Creation and configuration of a complex, heterogeneous sales structure with different hierarchies, managing advisors, managers, and associated third-party firms.

Product catalog

Management of the entire product catalog, configuration of operational information, and integration with real-time market data quotes.

Real-time data exchange

Connection with major banks, insurance companies, and asset management firms, acquiring balances and transactions in real time.

Reporting

Generation of customized reports and extracts required for regulatory submissions to authorities such as the Revenue Agency, Consob, and the Bank of Italy.

Do you have a project in mind?